“The Psychology of Money: How Emotions Influence Financial Decisions”

In the world of finance, numbers may dominate the headlines, but behind every financial decision lies a complex interplay of human emotions. Whether you’re investing in stocks, buying a house, or saving for retirement, your feelings play a more significant role than you might think.

Understanding Behavioral Finance

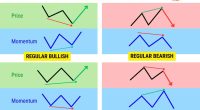

Behavioral finance is a field that combines psychology with economics to explain why people sometimes make irrational financial decisions. It explores concepts like loss aversion, overconfidence, herd mentality, and emotional bias.

For example, studies have shown that people feel the pain of losing money twice as strongly as they enjoy gaining it. This can lead to overly cautious behavior, missed investment opportunities, or panic-selling during market downturns.

The Role of Fear and Greed

Fear and greed are two of the most powerful emotions in the financial world. Fear can prevent people from taking calculated risks, while greed can drive them to chase unrealistic gains, often ignoring the risks involved. The 2008 financial crisis, for instance, was largely fueled by irrational risk-taking driven by greed, followed by mass panic and fear-based decisions.

Money and Identity

Many individuals tie their self-worth to their net worth. This can result in unhealthy spending habits, excessive debt, or pressure to maintain a certain lifestyle. Understanding that money is a tool—not a measure of personal value—is essential for emotional well-being and financial success.

Practical Tips for Emotionally Intelligent Money Management

1. Create a financial plan – Having a strategy can reduce emotional reactions during financial stress.

2. Avoid impulsive decisions – Give yourself a cooling-off period before making major purchases or investments.

3. Diversify your investments – Spreading risk can help mitigate emotional highs and lows.

4. Practice gratitude and contentment – Financial peace often begins with appreciating what you already have.

Conclusion

Money is more than just math; it’s emotional. The more we understand the psychological drivers behind our financial behavior, the more control we gain over our future. Smart finance isn’t just about saving and investing—it’s about self-awareness and emotional discipline.