Pros and Cons of Online Savings Accounts

Here are the advantages and disadvantages of owning a online savings account.

Advantages

- Higher Interest Rates: You benefit from higher rates than traditional banks. Rates often reach up to 1.5% as of 2023.

- Fewer Fees: Most online savings accounts do not charge monthly fees. This saves you money over time.

- Convenience: You can access your account anytime, anywhere. All you need is an internet connection.

- Automatic Savings Options: Many online banks offer tools to automate savings. This helps you save without thinking about it.

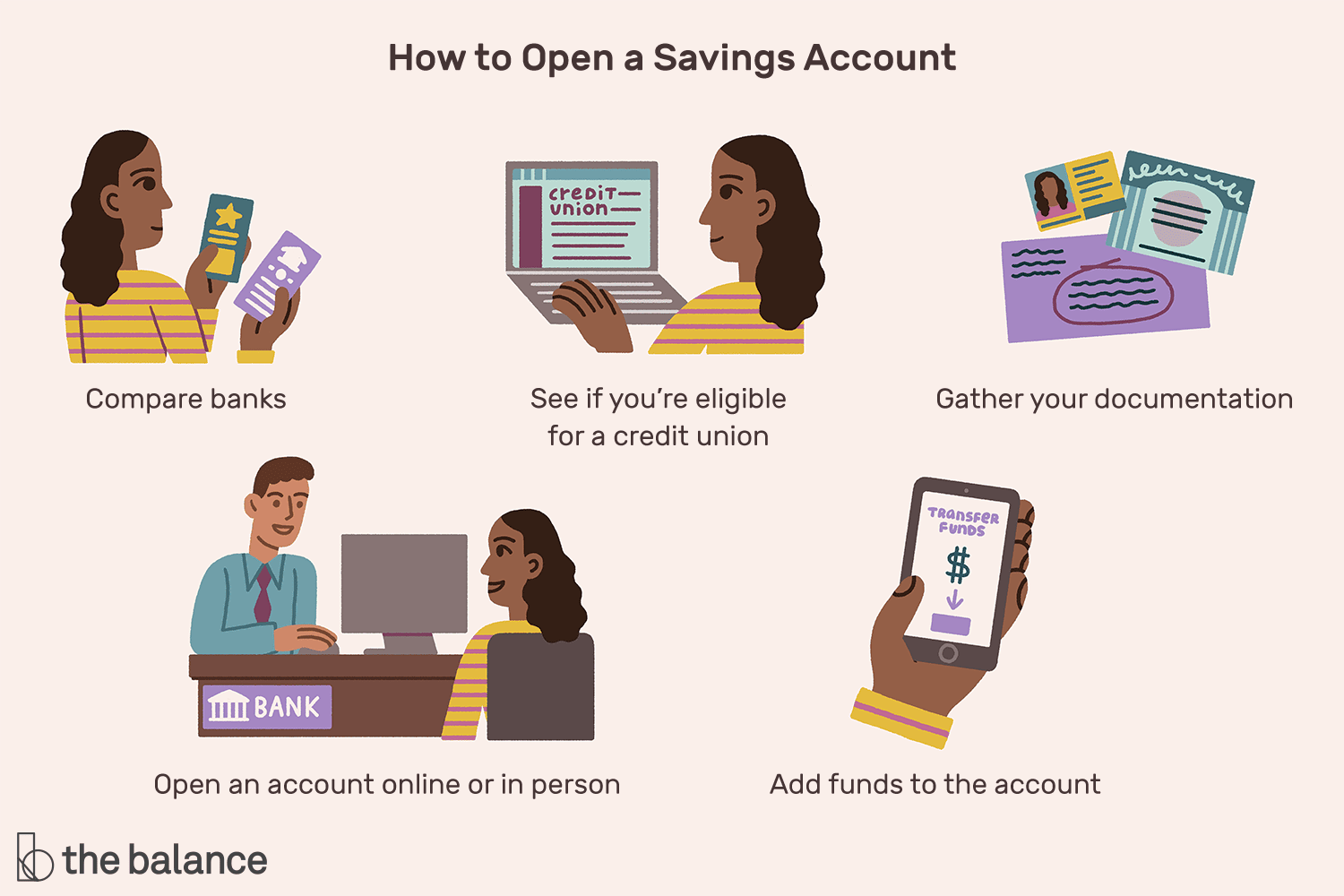

- Quick Account Opening: You can open an account within minutes online. This is much faster than in-person processes.

Disadvantages

- No Physical Branches: There are no locations to visit for in-person service. This can be a drawback if you prefer face-to-face interaction.

- Dependence on Internet Access: You need a reliable internet connection to manage your account. This can be problematic in areas with poor connectivity.

- Limited Deposit Options: Depositing cash can be difficult or impossible. You often need to transfer funds electronically.

- Potential for Technical Issues: Online platforms may have downtimes. This can temporarily prevent access to your funds.