What are Savings Accounts With Automatic Savings Features? Is it Worth?

Have you ever wished saving money was just a bit easier? Well, savings accounts with automatic savings features might just be what you need. These accounts are designed to take the guesswork out of saving money, making it automatic and, frankly, a no-brainer. Let’s dive into how these accounts work and whether they’re worth considering for your financial goals.

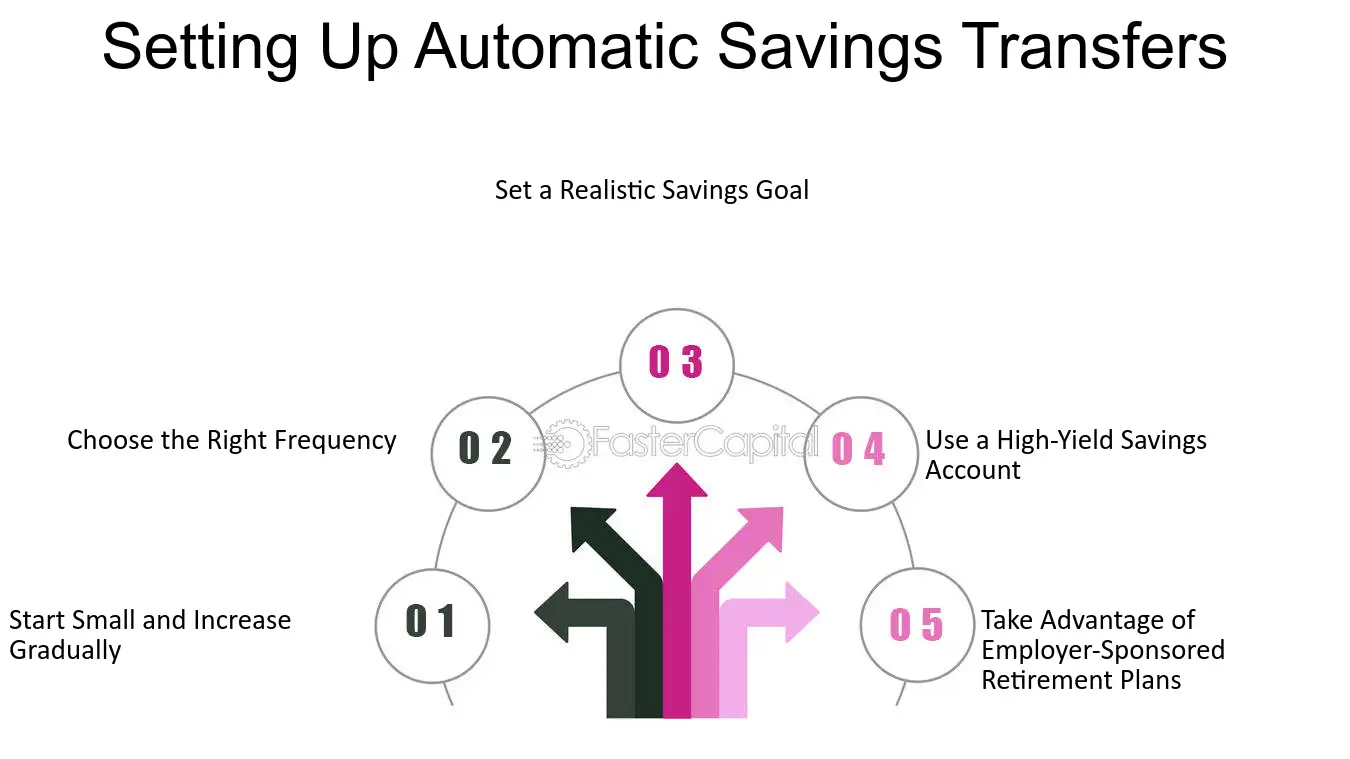

Imagine every time you make a purchase, your bank rounds up the amount to the nearest dollar and deposits the difference into your savings account. Or, perhaps on a set schedule, a predetermined amount automatically transfers from your checking to your savings account. That’s the convenience offered by these accounts. They are built to help you save without having to think about it every time.

These features are not just about stashing away pennies. Over time, they add up, potentially giving your savings a nice boost without a heavy lift from you. Plus, these accounts often come with apps that track your progress and show you how small savings accumulate into significant sums.

But are these accounts really worth it? Do they make a meaningful difference in how you save, or are they just another banking gimmick? In this article, we’ll explore the ins and outs of savings accounts with automatic savings features, helping you decide if this tool is right for boosting your financial health. Let’s find out how to make saving as painless as possible and whether these accounts can truly help you meet your financial goals.