Pros And Cons of Cash Management Account

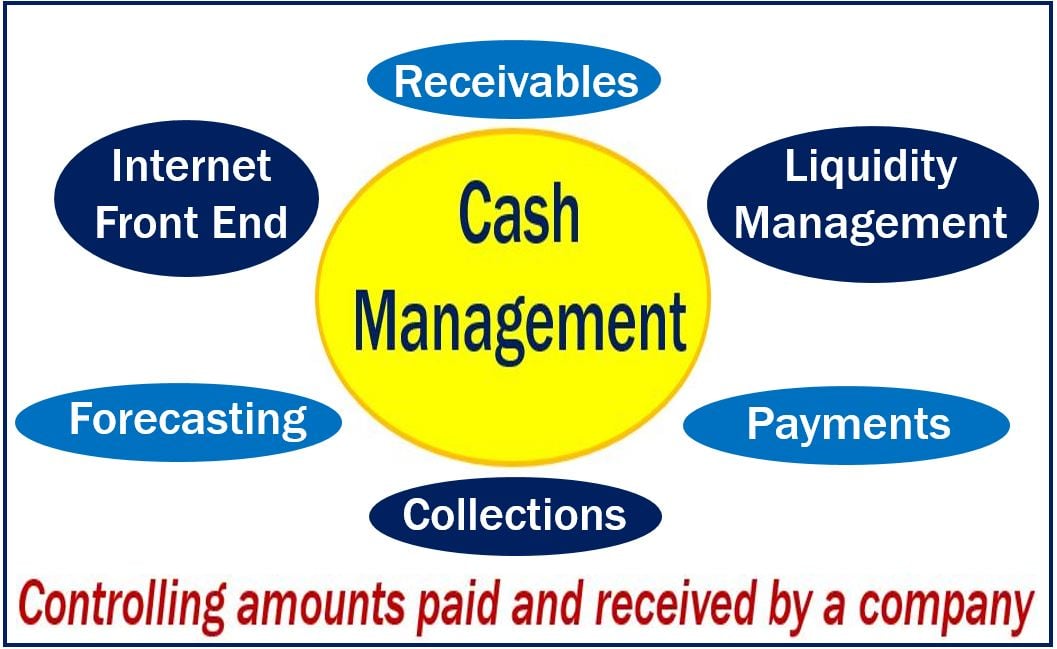

Considering a cash management account (CMA)?

Let’s weigh the pros and cons to see if it’s right for you. Here’s a quick rundown of the pros and cons to help you decide:

Pros:

All-in-one Convenience: Combines checking, savings, and investment accounts into one. Manage your money without switching accounts.

Higher Interest Rates: Typically offers better rates than standard checking accounts, making your money work harder.

Fewer Fees: Many CMAs come with no monthly fees, no minimum balance requirements, and free ATM access.

Easy Access to Investments: Being often offered by brokerage firms, they allow quick transfers between investment and cash accounts.

Enhanced Features: Includes perks like mobile check deposits, bill pay, and sometimes even budgeting tools.

Cons:

Lower Yields than Specialized Accounts: May not offer as high interest as dedicated high-yield savings accounts.

Limited Banking Services: Since they’re usually offered by brokerages, you might miss out on some traditional bank offerings.

Potential Overdraft Fees: If not managed carefully, you could face high fees for overdrafts, unlike some bank accounts that offer overdraft protection plans.

Complexity for Some Users: The combination of banking and investment features might be overwhelming if you prefer simple banking solutions.

Keep these points in mind as you consider whether a CMA is the right financial tool for you. It’s all about finding the perfect fit for your lifestyle and financial goals.