How Does Foreign Currency Swap Work?

Foreign currency swaps are used primarily to hedge against currency risks and optimize the financial performance of global investments. This complex financial product is structured to include the exchange of both principal and interest payments. Here’s a breakdown of how these swaps typically work:

Operational Framework

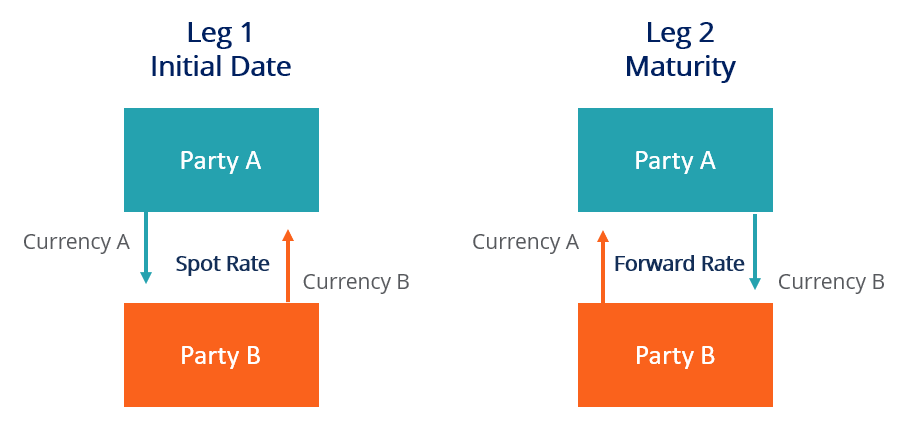

In an FX swap setting, two parties exchange a set amount of money in their own currencies at the start. Then, throughout the dance (the swap term), they make interest payments to each other, like renting the borrowed currency. Finally, they swap back the original amounts, completing the dance.

Initial Exchange

The journey of an FX swap begins with what is known as the initial exchange. Here, the involved parties agree to exchange principal amounts in two different currencies at a rate agreed upon at the start of the contract. This rate is usually reflective of the current market exchange rates, ensuring that the swap is initiated on equitable terms.

For instance, consider a U.S. corporation that needs Euros for operations in Europe but finds more favorable interest rates in USD. Similarly, a European company preferring to borrow in Euros might find it cheaper to raise USD. These two entities could enter into a foreign currency swap by exchanging their respective needs, thereby satisfying their financial requirements more economically.