How Currency Pairs Work

When trading Forex, you are simultaneously buying one currency and selling another. The price of a Forex pair is how much one unit of the base currency is worth in the quote currency. For instance, if the EUR/USD is trading at 1.20, it means that one euro is worth 1.20 US dollars.

Trading decisions are often based on how traders feel the economies associated with each currency will perform. If a trader believes the euro will strengthen against the dollar, they would buy EUR/USD. Conversely, if they think the euro will weaken, they would sell EUR/USD.

What Are the Types of Forex Currency?

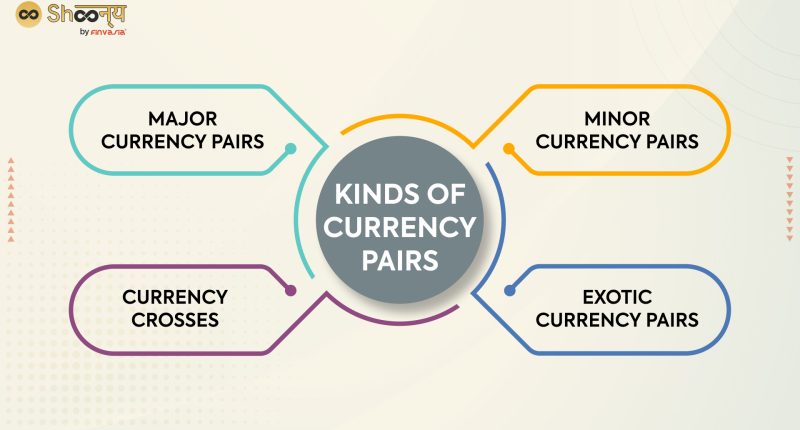

Currency pairs are categorized into three main types: majors, minors, and exotics. Each category has distinct characteristics and is used in different areas. Let’s take a look at their functions.

Major Currency Pairs

Major currency pairs, or simply “majors,” are the most traded currency pairs in the world. Each one of them includes the U.S. dollar (USD) on one side. Majors are highly popular among traders due to their liquidity and low spreads, which mean they can be bought and sold quickly without causing significant price changes. The liquidity is largely because these pairs represent the world’s largest economies.

Examples of Major Currency Pairs

EUR/USD (Euro/US Dollar): This is the most traded currency pair globally, representing two of the largest economies in the world, the Eurozone and the United States.

USD/JPY (US Dollar/Japanese Yen): This pair represents the forex relationship between the United States and Japan, thereby offering tight spreads and potential for profitability based on economic disparities and similarities.

GBP/USD (British Pound/US Dollar): Often termed the “Cable,” this pair describes the trading relationship between the British and American economies.

USD/CHF (US Dollar/Swiss Franc): Known as the “Swissie,” this pair is valued for its stability since the Swiss Franc is considered a safe currency.

Minor Currency Pairs

Also known as “crosses,” minor currency pairs do not include the U.S. dollar. Instead, they are composed of other major currencies. These pairs are less liquid than the major pairs and tend to have wider spreads. However, they offer valuable opportunities for traders looking to dividing their strategies away from the dollar.

Examples of Minor Currency Pairs

EUR/GBP (Euro/British Pound): This pair measures the value of the Euro against the British Pound, useful for traders looking at divergences between the Eurozone and British economies.

AUD/JPY (Australian Dollar/Japanese Yen): This cross provides insights into the Asia-Pacific markets, correlating often with commodity prices and Asian economic indicators.

EUR/JPY (Euro/Japanese Yen): This is a popular cross for traders who wish to avoid the USD but want to capitalize on the volatility influenced by the Eurozone and Japanese economic news.

Exotic Currency Pairs

Exotic currency pairs include one major currency paired with the currency of an emerging economy, such as countries in Asia, Latin America, or Africa. These pairs are less liquid than majors or minors and often come with higher spreads and volatility. They can be sensitive to political and economic uncertainties but offer high potential returns.