Key Components of a Foreign Currency Swap

Foreign currency swaps allow parties to exchange and manage risk in different currencies. Find out the key components that make these swaps function here.

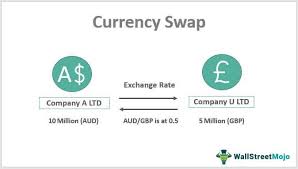

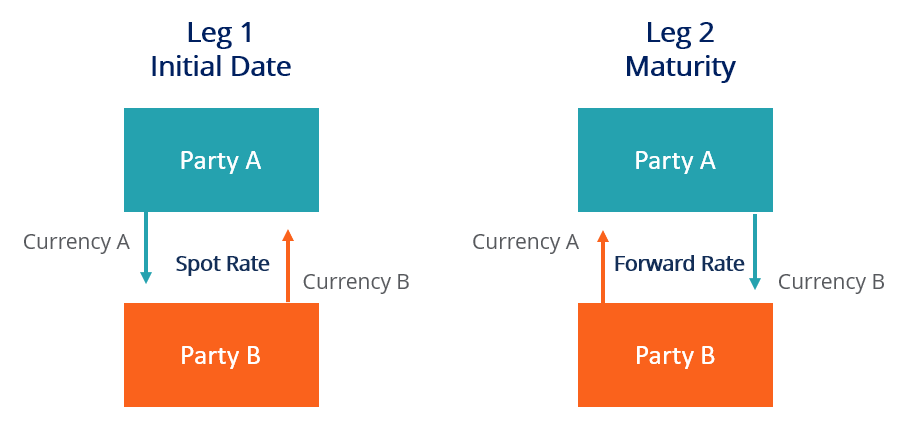

1. Exchange of Principal: Initially, the principal amounts in two different currencies are exchanged between the parties at an agreed-upon rate.

2. Interest Payments: Throughout the life of the swap, each party pays interest on the borrowed currency. These payments can be fixed or floating, depending on the terms of the agreement.

3. Re-exchange of Principal: At the termination of the swap, the principal amounts are re-exchanged at either the same rate as the initial exchange or a different agreed-upon rate.